Quarterly Update from Accolade Industrial Fund

This quarter, we've seen solid progress and strategic expansion, even as we adapt to the market's dynamics.

Key highlights include:

Portfolio Expansion: Our leasing activities have been productive, adding 24,000 m² from new leases. We're also excited to announce our entry into the Netherlands with the acquisition of the Roermond industrial and logistics park near the city of Venlo. The park includes two buildings totalling nearly 44,000 m², with an investment exceeding 48.4 million EUR. CooperSurgical is a new tenant, leasing over 18,000 m² as a distribution centre for Europe, the Middle East, and the Asia-Pacific region. Additionally, GXO, a global leader in logistics solutions, has leased a second facility of 25,000 m², which will serve as a distribution centre for a renowned online fashion retailer, further enhancing our portfolio's value.

Rent Growth Potential: A significant highlight is the considerable potential for rent increase in our portfolio. The growth in market prime rents outpaces the growth in our average fund rents, offering substantial room for further rent escalations, particularly in projects with expiring leases. This trend is expected to gain momentum in future periods, underlining a strong potential for fund growth.

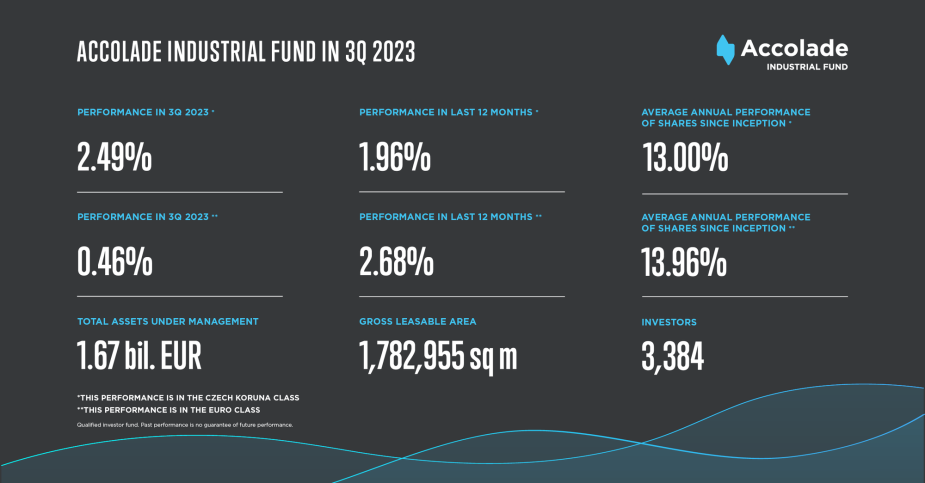

Positive Investor Returns: The fund demonstrates a positive trajectory, though year-over-year returns are slightly below initial expectations, echoing general trends in the European real estate market. Importantly, Crown investors have successfully navigated the earlier Czech koruna fluctuations.

Future Focus: Our commitment to investing in high-quality European business facilities remains unwavering. This strategic approach is key to navigating the current market and driving long-term growth.

We are thankful to our investors for their ongoing support . Your confidence is crucial as we navigate these times, setting the stage for continued growth and stability.